Why Your 1.22% Wholesale Club Credit Card Processing Isn’t Even Close to 1.22%

From time to time we speak to business owners who have organized their credit card processing through a wholesale club. Walk into one of these big box stores, and you’ll frequently see signage right at the entrance, promising extremely low rates, security, reliability…a real bed of roses. And since anyone walking through those doors is conditioned to believe that they’re entering a palace of cheap prices, it seems plausible.

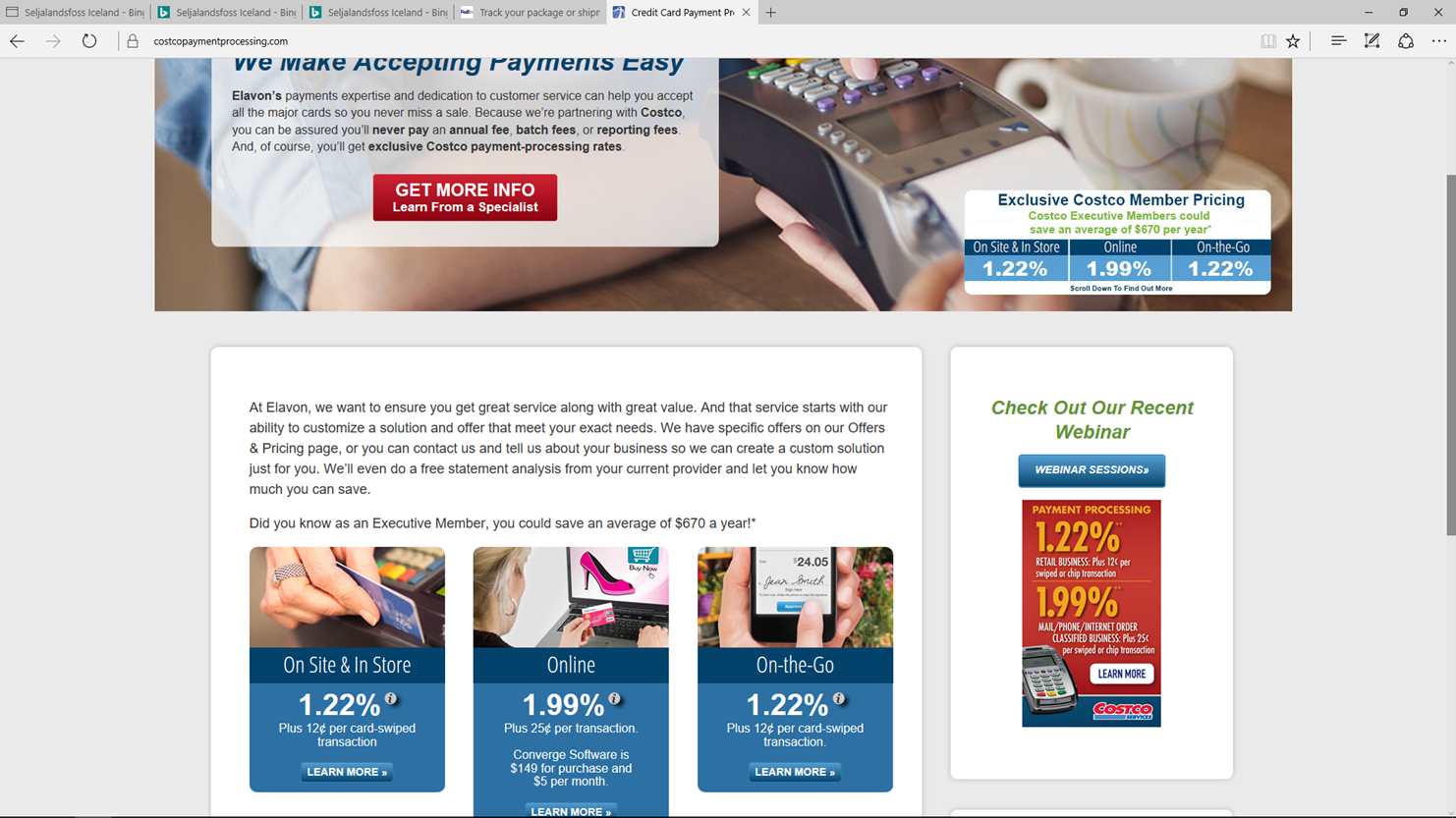

Here are the numbers that are going to stick in their heads*:

Secure in the comfort that they’ve gotten a great deal, these business owners shut down to hearing about what they’re REALLY paying, and how they’re spending much more than they should for these services.

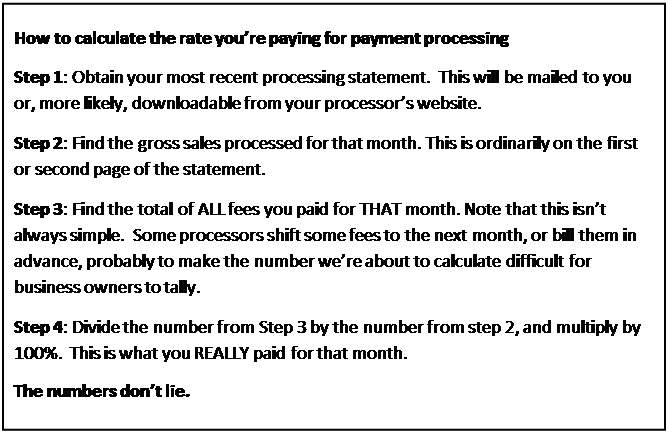

The first thing to bear in mind is: numbers don’t lie. It’s actually VERY easy to calculate what you’re paying for processing:

So, does that look anything like 1.22%? It most certainly does not! And here’s why.

See the asterisks next to those glimmering, shimmering numbers presented by Wholesale Club? They’re explained in the fine print:

“*Visa/MasterCard/Discover service is sponsored through Elavon. Rates listed are for qualified transactions. A monthly minimum charge applies when total transaction fees and per-item charges are less than $20 per month. A $25 Application Fee and $4.95 Monthly Statement Fee apply for Non-Executive Members. Rates and fees may change without notice. Rate and acceptance are subject to underwriting.”

The key phrase here is “Rates listed are for qualified transactions.” Do you know what a “qualified transaction” is? Probably not, and it’s going to cost dearly not to know, if you go with Wholesale Club’s processing. Let’s break it down and see why.

A credit or debit card transaction is a retail product you “buy” from your processor. That’s right, you’re buying a product. And like the products you sell, there is a cost to “manufacture” that product, a wholesale cost that the “distributor” pays the “manufacturer,” and a retail cost that you, the consumer, pay. In this case, the “manufacturer” is the card association (Visa, MasterCard, etc.) and the banking system, and the “distributor” is the processor (the company that provides your monthly statement, customer service, tech support, among many other functions.)

Your processor buys at wholesale and marks that up to create your “retail” cost. And as with any pricing, the retail price MIGHT be related to wholesale, it MIGHT simply be what the market will bear, but it definitely won’t be BELOW the wholesale cost. No business can sell below cost for long without going out of business (obviously.)

The wholesale cost of a credit or debit card transaction is determined by the card presented and the way it’s taken. All of the various bells and whistles (airline miles, points, cash rebates, fancy reporting, etc.) that go along with cards are factored into the wholesale price of a transaction that card is used for. In addition, the risk of fraud that comes from different methods of payment (face-to-face with a chip, mag stripe swiping, read over the phone, entered online) is factored into the wholesale price. Along with a few other costs the manufacturer bears (and their profit,) all of these costs make up the “wholesale” price.

Wholesale prices of credit and debit card transactions are publicly available. You need to know a little bit about what you’re looking for and looking at, but you can find these prices in places like this:

https://usa.visa.com/support/small-business/regulations-fees.html

One thing you’ll note which should really raise your suspicion: VERY few of these carry a rate as low as the flashy 1.22%* shown in Wholesale Club’s marketing material. Remember, a business can’t sell below cost for long…

“Rates listed are for qualified transactions.” Wholesale club’s partner decides what is a qualified transaction, and what isn’t. They put all transactions into one of three categories that they call “Qualified,” “Mid-Qualified,” and “Non-Qualified.” That 1.22%* applies to “Qualified” transactions. The rates for the other two are not shown in the ad, and they are much, much higher than the 1.22%*. This “Tiered” pricing, as it’s called, is a rigged game. Wholesale Club’s partner decides which transactions go into each category. The 1.22%*? That’s made up of debit cards, the wholesale price of which might be as low as 0.05% plus $0.22. There is ONE type of credit card in that category, relatively seldom used, that carries a wholesale cost of around 1.5%. So they lose money on that one. But boy oh boy, do they ever make up for it in the other two categories…

Wholesale Club’s partner can change the rules if they don’t like how the game is going. “Rates and fees may change without notice.” This means they can change the composition of each category, and the price you pay for transactions in each category, at will, with no notice. Sounds like a casino, changing the payout on their slot machines, if they decide to make more money. Casinos can be fun, but most people recognize you don’t go there for a good deal.

The House Always wins in the end. Bottom line, if you’re taken in by the Wholesale Club flash, you’re going to overpay, and probably by a lot.

We have a better, cheaper solution. We offer business owners a totally different model: pass-through of the actual wholesale costs, plus a small and transparent charge for our processing services. No rigged game, no smoke and mirrors. No hidden multi-year contract terms, no termination fee if you want to switch service. We’re trusted by industry associations to handle their member benefit in the payment processing realm. Let us tell you more about how we can help you avoid the Wholesale Club trap, and save hundreds if not thousands annually.