“We negotiated great rates. What happened?”

The Bottom Line:

- Wholesale rates from the card brands do go up periodically, but rarely “across the board”

- SOME card processors notoriously raise rates once a year, under the false guise of card brand increases (Call and ask us which are the worst offenders)

- This can lead to dramatically higher rates over time

- Your processing provider should be pushing back against discretionary rate increases

- Using published sources, we’re happy to analyze your processing statement to identify which charges are “pass-throughs,” and which are discretionary

The last time you switched payment processing providers, you carefully examined rates, maybe compared competing offers, and came away with possibly substantial cost reduction compared with your previous arrangements. Some time later, you’ve used our simple formula (total fees paid divided by gross sales) and found your rates seem to be significantly higher than what you expected. And looking back, you can see that the net rates you’ve paid have gone up over time. What happened?

Visa, MasterCard, Discover, and American Express DO periodically make changes to the rates they charge. These rates are referred to as “interchange” and “dues, fees, and assessments.” These charges apply the same to businesses of a given type (e.g. retail, supermarket, restaurant, etc.) regardless of the size of the business. WalMart gets the same rates as the kiosk in the mall.

As the saying goes, when it comes to these rates, you should “trust, but verify.” Your processor may be telling you, usually through a notice on your monthly statement, couched in “official-sounding” language, that your rates are going to have to go up. The good news is, these rates are published, and we can direct you to the sources.

The infuriating game for these companies seems to be that they hope you won’t notice the rate increase, or that if you do, that you’ll take their word for it that it’s unavoidable. Over time, some businesses will identify this game, and either push back, or leave. Even in the case of losing business altogether, there seems to be an “acceptable losses” mentality among the processors that do this.

And why not? These companies may easily double or triple what they’re making from your business. And the agent who set up your account, who should be standing up for you, is in on the game, too. Their compensation derived from your account is going up as well. In their book, better to take a few losses and grab higher fees from all the rest.

And by the way, in the application document you signed will be a reference to “terms and conditions” and your acceptance of these terms. These universally permit the processor to unilaterally raise rates whenever they want to, in their sole discretion. It’s vital that you keep a copy of your application/contract so that you can compare discretionary rates and charges to those promised you when you opened your account.

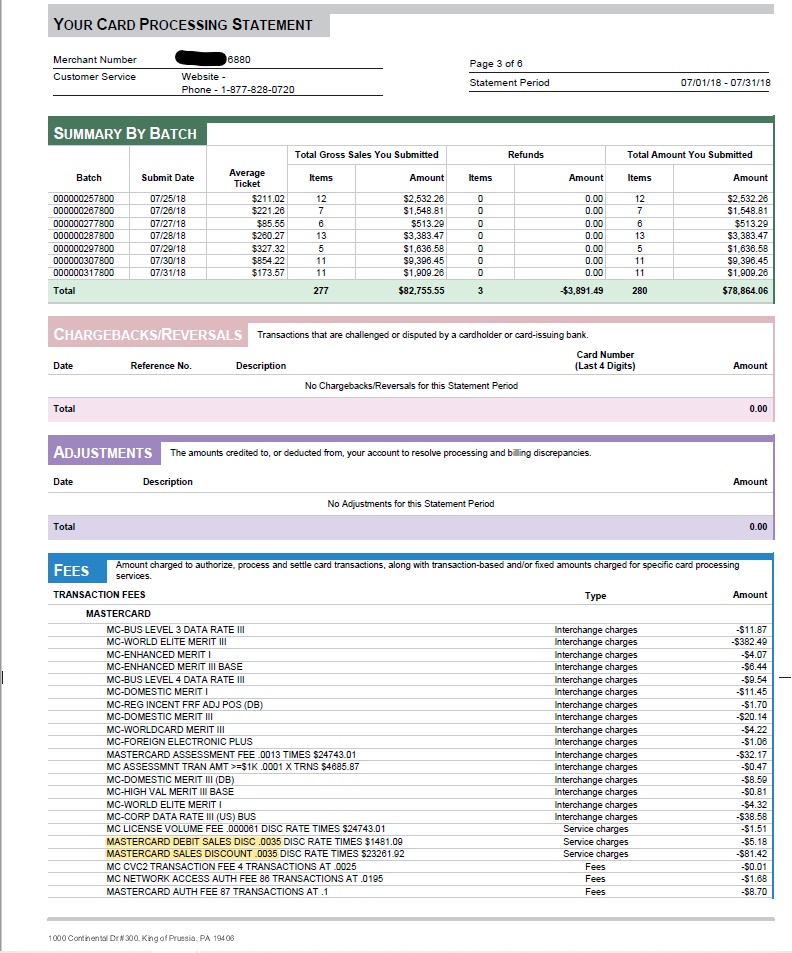

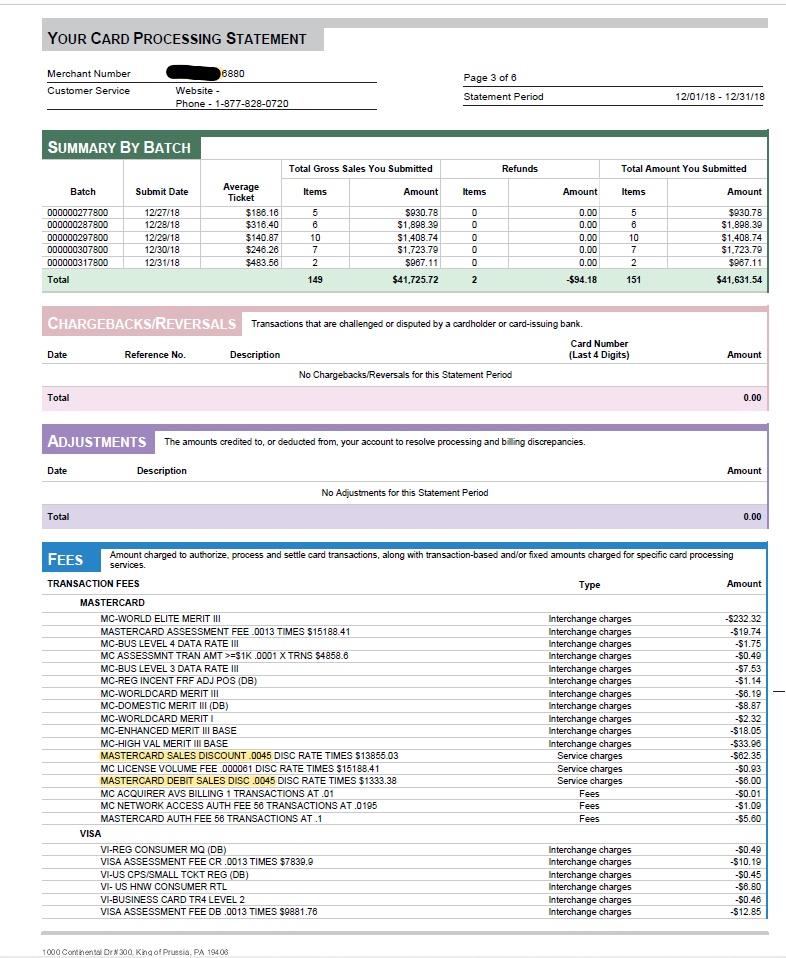

Here’s an example. These are pages from two statements obtained from a member of one of the industry groups that we serve. First, from July 2018, and second, from December 2018.

Small print, to be sure (isn’t that always the way?) but look at four numbers. Each statement has a line labeled “MASTERCARD SALES DISCOUNT,” and another labeled “MASTERCARD DEBIT SALES DISC.” These charges – and their analogs in the other card brands (Visa, Discover, American Express) – represent the bulk of what the processor makes in compensation. And note that between July and December, this processor raised that charge by nearly 30%, from .35% to .45%. Over the course of a year for this business, that increase is $500 per year. There was NO ACTUAL WHOLESALE COST INCREASE to justify that change. It was simply the processor deciding that the commitment they made to this business with the contract they signed was discardable, because they felt like making more money. Shameful.

Small print, to be sure (isn’t that always the way?) but look at four numbers. Each statement has a line labeled “MASTERCARD SALES DISCOUNT,” and another labeled “MASTERCARD DEBIT SALES DISC.” These charges – and their analogs in the other card brands (Visa, Discover, American Express) – represent the bulk of what the processor makes in compensation. And note that between July and December, this processor raised that charge by nearly 30%, from .35% to .45%. Over the course of a year for this business, that increase is $500 per year. There was NO ACTUAL WHOLESALE COST INCREASE to justify that change. It was simply the processor deciding that the commitment they made to this business with the contract they signed was discardable, because they felt like making more money. Shameful.

What can you do? First, you really do want to pay attention to your monthly statements. Do the simple calculation each month: Total fees charged divided by gross sales. If that number goes up and stays up (monthly variations are inevitable,) it’s time to get a third party to review your statements. On your own, you can compare the “interchange” rates you’re being charged with published rates. Finally, be particularly vigilant in reading the messages on your monthly statements. If you see ANYTHING stating that rates are going up, it’s time to push back, demand proof that the increases are in fact coming from the card brands, and verify that what you’re being told is true.

We find instances of this kind of rate creep all the time. We’ll be happy to review your statements and identify the accuracy or lack thereof in the rates portrayed as “pass-throughs.” With a little more help from you in the form of your original application, we’ll also identify where discretionary charges may have changed over time. And if you’ve been treated unfairly by your processor, we’ll be happy to help you move.

Your action items:

- Keep a copy of your application or contract for future comparison to your rates

- Calculate your net cost of processing each month, and track that number

- Read your monthly statement notes, and flag any mention of rates going up, regardless of how “official” it sounds

- Push back on any announced rate increase, demanding proof that it is actually non-discretionary

- Seek help from a third party to find current pass-through rates, and compare these to what you’re being charged, as well as your discretionary charges to those you initially signed up for