Is it cheaper to run a debit card as a “credit card,” or to take a PIN Number?

The Bottom Line:

- Debit cards are accepted two ways: “as a credit card” (called “signature debit,”) or with a PIN number (“PIN debit”)

- Traditionally, PIN debit transactions have cost merchants less than signature debit transactions.

- While new fees have narrowed the gap between PIN and signature debit costs, PIN debit transactions are still cheaper for almost all transactions.

- – The overall impact per year, however, might be small. For a business processing $200,000 in sales per year, 20% on debit cards, the cost reduction from accepting PIN debit cards might amount to roughly $100 per year.

Clients and prospective clients frequently ask us, “When is it cheaper to take a PIN number when we’re running a debit card transaction?” This article is going to provide a mathematically rigorous answer to that question. If you want to find out how to make sure you aren’t overpaying for debit card transactions, read on.

The relative cost of PIN debit versus signature debit transactions (those where a card is swiped or read, but no PIN is requested or entered) can be a point of confusion. Just like with credit card transactions, there’s complexity, and the rules change from time to time. Developments since the passage of banking reform in 2010 have made things more complicated, with factors favoring and disfavoring PIN debit coming into play. Bottom line, for retail businesses, in all but the smallest transactions, there is a “one size fits all” answer to your questions about which approach provides the lowest cost for your business.

Differences in processing PIN versus signature debit transactions

Understanding whether it’s cheaper to run a PIN debit versus signature debit transaction requires a brief description of how these two options differ. A signature debit transaction operates just like a credit card transaction. You swipe or insert an EMV card into the reader, the transaction runs, the customer signs and it’s done. It looks like a credit card transaction because it follows exactly the same kind of path – over the same Visa or MasterCard network – that a credit card transaction follows.

A PIN debit transaction, on the other hand, follows a completely different path, on a different network. The banking network that handles a PIN debit transaction shows its logo on the back of the debit card. Common networks are Star, Pulse, NYCE, and many others. Just as the credit card networks charge “interchange” fees for running transactions over their networks, the debit networks do the same.

Whose card is it?

Since 2010, how much it costs to process a debit card transaction has depended, rather strangely, on the size of the bank whose name is on the debit card. Presumably to punish big banks and others for their role in the financial crisis of 2008, Congress limited the amount that they can charge for debit transactions. This led to a two-category price model: if the bank, savings association, or credit union has assets of $10 billion or greater, the most they are allowed to charge for a debit transaction, whether PIN debit or Signature debit, is 0.05% plus $0.22. This is referred to as a “regulated” transaction. If the debit card issuing financial institution has less than $10 billion in assets, then there is no regulated limit on the interchange fee that can be charged. This is referred to as a “non-regulated” transaction. The majority of transactions a typical merchant will see will be “regulated.”

Cost of a debit transaction

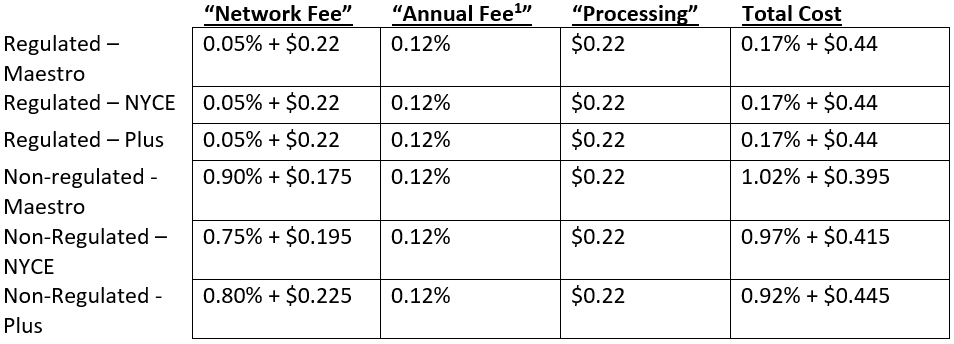

The tables below shows what overall costs are currently for several types of common PIN and signature debit transactions.

PIN Debit Costs

[1] Trying to make up some of the revenue they’ve lost to the 2010 banking regulations, PIN debit networks have started charging an annual fee for taking their cards, in addition to the transaction charges. At present, four networks do so, adding $48 per year in cost. This figure is the approximate impact those annual fees have on a merchant with $200,000 in annual volume, taking 20% debit cards. The figure goes down with more volume, up with less.

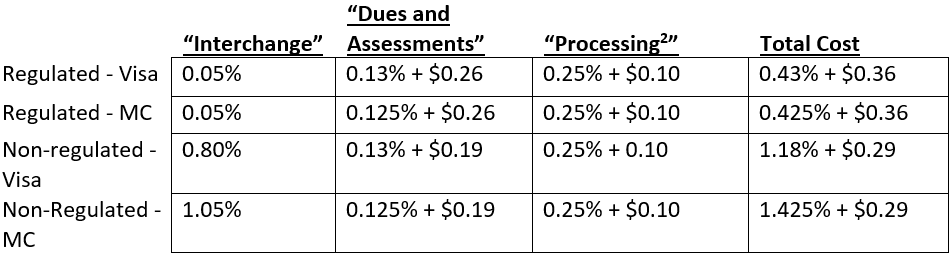

Signature Debit Costs

[2] Representative fees, discretionary and can vary by processor.

As you can see, PIN debit transactions carry a lower rate, but a higher per transaction cost. The implication of this is that for small transactions, signature debit cards hold a cost advantage, but this disappears at a relatively small transaction size.

So which is cheaper for my business: PIN debit or signature debit?

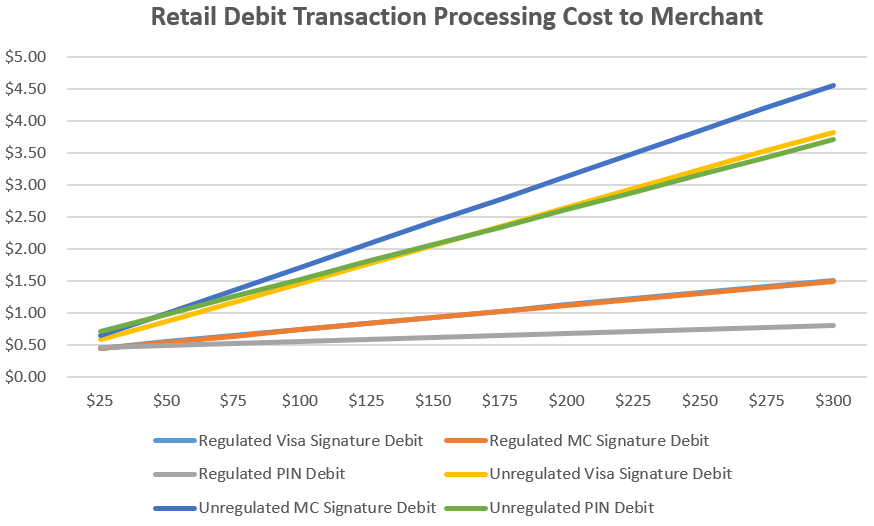

Adding these various rates and fees together and applying them to retail transactions of various sizes, we’ve created the graph below:

Thus you see that under the assumptions we’ve outlined here, for transactions greater than ~$25, your all-in cost is going to be lower with a PIN debit transaction, regardless of whether the customer’s card has been issued by a large financial institution or a small one. However, the difference in cost, based on our assumptions, is relatively modest. With competitive rates and practices, by our calculation the difference in cost over the course of a year for a business with $200,000 in sales and 20% debit cards would be in the range of $100.

Other Considerations

Making sure you’re getting the lowest cost for your transactions requires a trusted processing partner. We frequently talk to business owners whose current processors are charging above market rates for processing, hiding fees, adding on fees that have no real basis in business reality, etc. You want to be sure that you have interchange plus pricing, and that your processor is not charging a proportion of volume on PIN debit transactions. We’re always happy to provide a complimentary analysis of rates and practices since we love to shine a light on unfair and shady practices.

You may notice that your terminal never asks for a PIN number. Or used to in the past, then stopped. Processing platforms are still dealing with the adoption of EMV cards in 2015. Some simply do not yet have the capability of accepting EMV PIN debit transactions. Opting to place greater importance on EMV, they’re getting to this, but (obviously) slowly. Your processor may be in this boat. Not ideal, but you can take some consolation in the relatively small annual impact of this deficiency. It will probably be rectified in the future.

Finally, if you operate a specialized business dominated by low ticket sizes, say a quick serve restaurant, coffee bar, dry cleaner, you may want to consider NOT accepting PIN debit at all. If the bulk of your revenue comes from transactions less than $25.00, you may well lose nothing in cost, and improve workflow by avoiding the somewhat more lengthy point of purchase time associated with PIN debit transactions.

Several assumptions have gone into these calculations. We steadfastly believe in giving our readers and clients the knowledge they need to understand – fairly and accurately – what they’re paying for, and whether they have a competitive contract. Get in touch and we’ll be happy to walk you through our calculations, discuss how sensitive overall costs are to various assumptions, and review your current contract for overall payments processing efficiency.